State of Logistics Report finds a supply chain working to get back into synch amid rising costs

Jason Cannon, CCJ chief editor

Jun 21, 2022 |Updated Jun 22, 2022

While U.S.-based supply chains are out of sync they are also facing rising costs, according to the 2022 State of Logistics Report. The annual report is produced for the Council of Supply Chain Management Professionals (CSCMP) by consulting firm Kearney and presented by Penske Logistics. It was unveiled Tuesday at the National Press Club in Washington, D.C.

Last year's report noted the effects of the pandemic on the supply chain and the 2022 report found that residual challenges of the pandemic remain, with some disruptions continuing to deliver damaging effects on capacity.

Explosion of the last mile

The 2022 report notes that e-commerce sales grew 10% last year (to $871 billion), accounting for 14% of U.S. retail sales. Trucking freight continues to see more volume and opportunities. With road freight accounting for the largest segment of the U.S. supply chain spend, it expanded by 23.4% to $831 billion.

The sudden growth and demand of the last-mile delivery system taxed and further exposed an already insufficient labor supply and overburdened infrastructure, the report found, causing pricing spikes, capacity shortages and some acute logistical challenges. Amazon accounted for 21% of all U.S. parcel volume and raised pay for drivers and other hard-to-fill positions.

Rising transportation costs

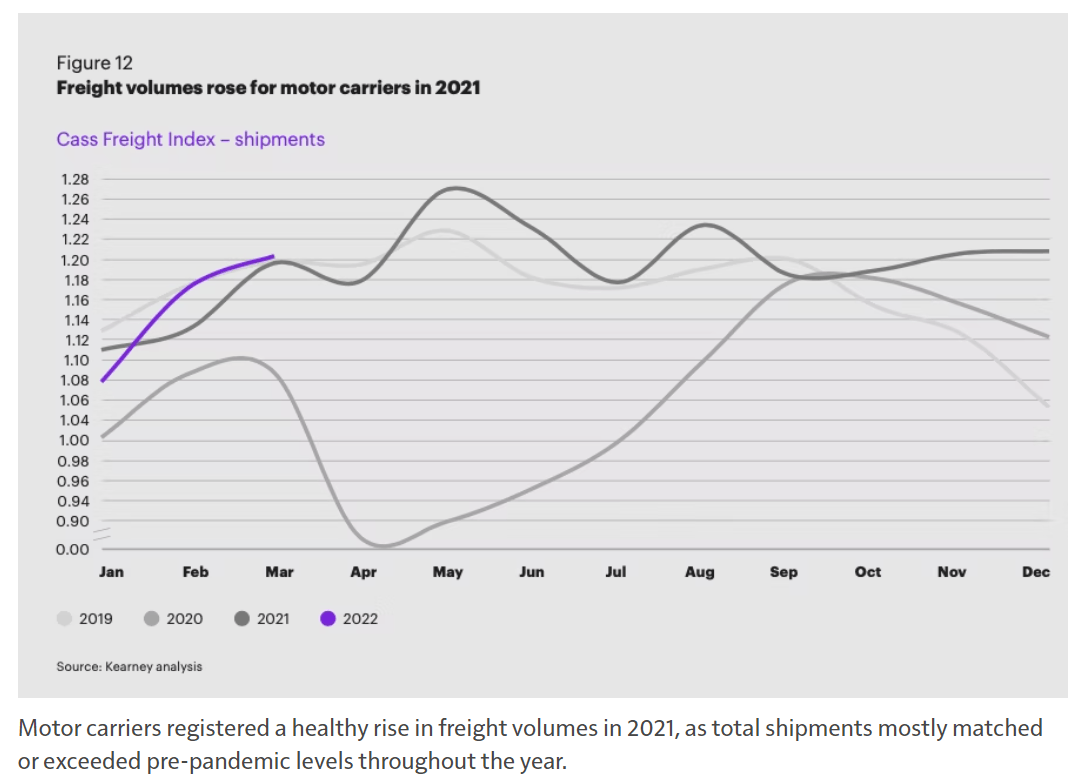

United States business logistics costs (USBLC), which includes transportation costs, last year jumped by 22.4% to $1.85 trillion, representing 8% of 2021's $23 trillion GDP. Motor Carriers saw a 23.4% spike in transportation costs. Truckload carriers shouldered a 10.2% jump, according to the report, while LTL carriers were hit for an extra 13.2%. However it was private carriers who took the most rigorous beating with costs spiraling 39.3%.

The stresses and demands placed on motor carriers in responding to the needs of their customers were further complicated by logistics and material shortages that prompted many shippers to pull orders forward to meet seasonal and holiday demand.

"The pandemic created demand for products that could help stop the spread of infection. As an essential business, we responded by doubling capacity of disinfecting wipes, going from an empty space to a high-speed automated line in nine months, and that meant our carriers also had to respond," Rick McDonald, chief supply chain officer at The Clorox Company, said in the report. "We got a much closer look at what our transportation partners could and couldn’t do, which informed who we’re going to be working with.”

Concerned with lost sales, shippers were willing to pay top dollar for truck capacity, which sent carrier profits soaring and shipper profits tumbling. The report found that shippers, upset at low service levels and high costs, increasingly see the development of their own truck fleet as a more reliable alternative that has become more affordable.

"Captive fleets rose to the occasion as they became more valued," Moses said, "driving an accelerated adoption that remains with us today. We’ve seen shippers that have gone 10 years without a private or dedicated fleet get into them.”

New opportunities

Manufacturers' efforts to increase multi-shoring are expected to accelerate in the years ahead, according to the report, as companies seek to move operations closer to the U.S. to facilitate a quicker response to fluctuating market demands, which could raise demand for North American regional and long-haul trucking substantially.

A March 2021 Kearney survey of U.S. manufacturing executives found that 41% had re-shored at least a portion of their manufacturing operations to the U.S. over the past three years, while another 22% said their company plans to re-shore some manufacturing within the next three years. In personal interviews, some executives voiced intent to reduce dependence on manufactured imports from any single country, particularly China.

Lingering high freight costs could spur ongoing experimentation as carriers seek a blend of truckload, LTL and intermodal services, which offers motor carriers opportunity to lower-cost services without sacrificing quality.

"The expansion of capacity and the development of new value propositions are among the most urgent imperatives for motor carriers in a dynamic and unpredictable market," the report stated.