Fleet execs struggle to gauge capacity trends ahead of peak season

Geert De Lombaerde

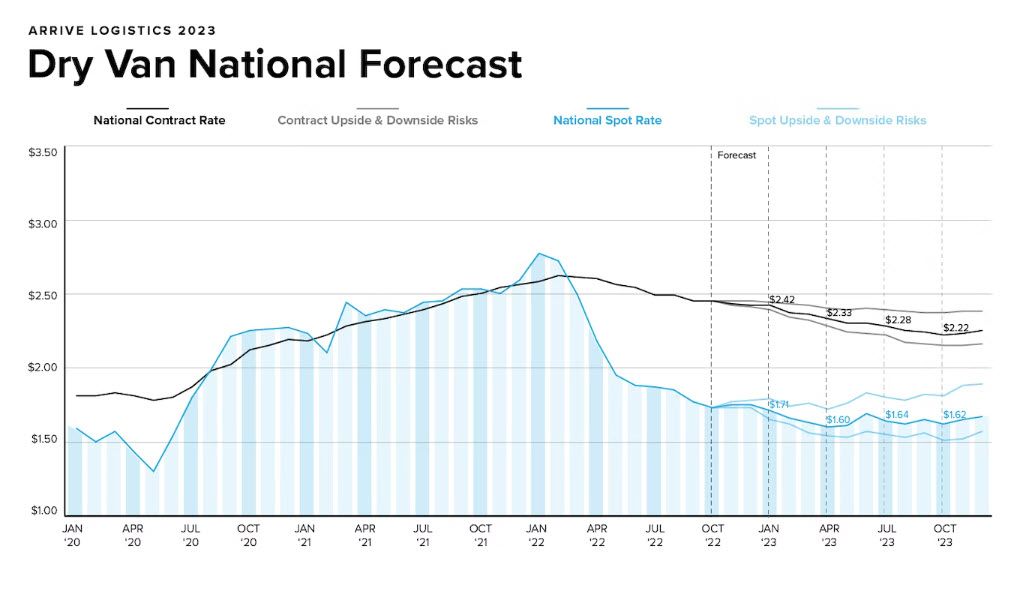

Restrained by higher entry, operating, and repair costs, excess capacity isn’t what it used to be because small trucking companies and independent drivers have retreated somewhat from the market.

Knight-Swift Transportation CEO David Jackson thinks this freight cycle is starting to look like no other before it because of the confluence of strong demand and high fuel and equipment prices along with the 2018 advent of the electronic logging device mandate. But just what that means for the upcoming peak season remains very unclear for carriers and their customers. As with other parts of the economy, cloudy data is making forecasting a tricky proposition this summer.

Speaking to analysts and investors on Knight-Swift’s second-quarter earnings conference call on July 20, Jackson said the industry is heading into 2022’s peak season with a different backdrop than in previous cycles. Restrained by higher entry, operating, and repair costs, excess capacity isn’t there as in the past because small trucking companies and independent drivers have retreated somewhat from the market – particularly as spot rates have fallen in recent months.

“We have never seen supply come out so early and appear to be coming out at the same pace—if not maybe even earlier—than demand seems to be waning,” Jackson said. “All indicators are that supply is contracting already as we speak […] So that has us thinking that this [cycle] could feel a little bit more orderly and [be] less of a drop-off.”

Jackson’s comments came after Phoenix-based Knight-Swift (No. 4 on the FleetOwner 500: For-Hire list) reported Q2 profits of $219 million on revenues of nearly $2 billion compared to $153 million and $1.3 billion, respectively, in the second quarter of 2021. Those numbers were powered by the company’s truckload and less-than-truckload segments posting operating ratios of 82.6% and 84.6%, respectively, as well as strong profit growth in its intermodal group.

The truckload unit’s revenue per tractor rose 11% year-over-year to more than $54,000 even as the company has emphasized shorter routes. Demand from truckload and logistics remains strong, executives said, and they added 1,700 trailers to Knight-Swift’s network in the three months ended June 30, growing it to more than 73,000 trailers.

Jackson and CFO Adam Miller said they expect overall consumer demand to moderate somewhat in the second half of the year. But, he added: “We acknowledge that we have less visibility on peak season surge as compared to the previous two years.”

Figuring out 2022's peak season approach

That sentiment was echoed a day later by his peers at Landstar System, which reported Q2 profits of nearly $113 million on about $2 billion in revenues—numbers that were up 22% and 26%, respectively.

Asked on his team’s conference call about the approaching peak season, President and CEO Jim Gattoni said Landstar (No. 10 on the FleetOwner 500: For-Hire) is hearing a number of different forecasts from customers. But at the same time, he added, many customers are themselves not sure about demand and are still looking to lock up trucking capacity should things turn out better than they now expect. That tussle, Gattoni said, is making it difficult for Landstar to forecast through the end of 2022.

“The conflicting messages get us to a stable environment for the next two months. How’s that?” he said.

Chief Commercial Officer Rob Brasher put it succinctly when asked for his gut feeling about peak season.

“My gut is upside down because no one can tell me what's going to happen,” Brasher said. “We base our peak really off of two parcel carriers and one big-box retailer. And I will tell you those three are about as far apart [as they can be] on what's going to happen.

“So I guess to answer your question, no one knows,” Brasher added, also noting customers’ desire to keep capacity on hand should they end up needing it. “So I know I didn't answer your question, but I haven't been able to get a straight answer out of them, either.”

Shares of Knight-Swift (Ticker: KNX) jumped the morning after Jackson and his team reported their results but have since given up much of that gain. Year to date, the stock has lost about 15% of its value, lowering the company’s market capitalization to about $8.3 billion. Landstar shares (Ticker: LSTR) have in recent days followed a similar path. So far in 2022, it is also down about 16%.