2022 Year in Review

Pervinder Johar, CEO, Blume Global | December 26, 2022

All players in the global supply chain can agree on one thing: 2022 has been quite the ride! The looming impact of the pandemic, fluctuating economy and wavering political instability are likely to leave lasting effects for many into the new year. That isn’t to say, however, that supply chain leaders lost their footing in this tumultuous year. If anything, it has reinforced the need for all to build resiliency into their supply chain strategies, and most importantly, remain flexible during periods of change.

As we prepare to ring in the new year, let’s take a moment to look back at a few of the major events that made waves through the industry this year.

Inflation reared its ugly head

And it isn’t going anywhere for a while. There are lots of theories around the cause of it, one being the large shift to ecommerce shopping habits while we were in peak pandemic lockdown. This exposed the existing holes in the existing infrastructure, and many had to go back to the drawing board to see how they could level up their operations to compensate. However, coupled with the amount of demand that surged, global supply chain backlogs occurred, and the price of goods skyrocketed. On the contrary, according to Logistics Management, companies have now found themselves awash in excess product. Other factors like high interest rates, soaring oil and gas prices, and the war in Ukraine contributed greatly to global inflation.

Record-level congestion became reality

Major ports all over the world that once operated with relative efficiency became plagued with delays, many with container ships queuing for days proving to be some of the worst congestion ever recorded. COVID breakouts and strict testing in China led to log-jammed ports. The port of Shanghai-Ningbo, for example, had more than 120 container vessels on hold, and trucking costs in Shenzhen rose 300 percent due to a backlog of orders and a shortage of drivers.

Stateside, similar congestion was seen at the major ports throughout the country, including west-coast ports LA/Long Beach and Oakland and New York and Savannah on the east coast.

Tension rose across modes

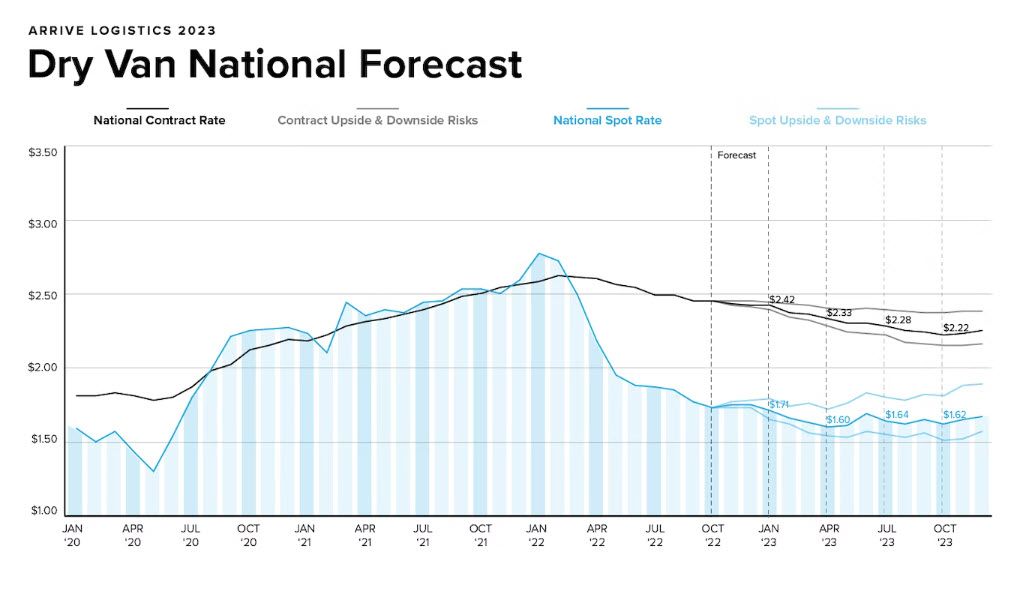

For trucking and intermodal/rail, it has been an especially taxing year. Trucking struggled with a driver shortage, along with a chassis shortage that left many without the capacity to meet the demand and caused congestion to build at yards. The aforementioned rise of fuel costs especially impacted truckers of all sizes on a global scale.

A potential strike over labor negotiations exposed how dependent the economy is on the flow of goods via rail. Railroads have slashed labor and other costs to bolster profits in recent years and have been fiercely opposed to adding paid sick time that would require them to hire more staff. If the rail strike happened, it could have frozen almost 30% of U.S. cargo shipments by weight, stoked already surging inflation, cost the American economy as much as $2 billion a day, and stranded millions of rail passengers.

Ocean freight rates dropped

For the last two years, we have experienced record-high container shipping prices. The trend is now finally reversing as backlogs at ports around the world ease. This trend in ocean freight orders was due to a combination of too much inventory and a lack of clarity regarding consumer demand. The decrease in demand spanned products including consumer electronics, machinery, housing, furniture and apparel.

Container shipping contract rates played a role, too. There was a moderate decline of spot rates in the first half of this year—which accelerated in August and September—and has slowed down since. Earlier this month, the weekly Drewry World Container Index showed a 78% decline in the global composite rate between Sept. 2021 and Dec. 2022. To provide more context, the Shanghai-Los Angeles index fell 84% over that period and the Shanghai-New York index dropped 73%. With contract negotiations approaching, 2023 is expected to bring even lower rates and volumes.

We’ve seen supply chain growth despite the pandemic, and that, as we all have seen, brings with it unique pain points. That’s why, this year, we redoubled our efforts to produce substantive, innovative technology solutions that help our customers bring agility into their supply chain processes. We have also maintained our commitment to sustainability and working for the good of all supply chain stakeholders by becoming carbon neutral.

All in all, we are honored to have served our customers through this year and look forward to what 2023 has in store.